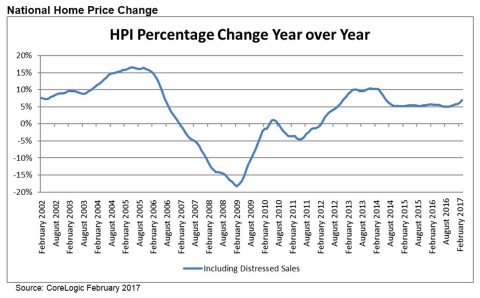

ConDig (4-Apr-17). US home prices rose 1% in February compared to the month prior and were also up 7% on the same period last year as robust demand levels continue to squeeze languishing supplies, according to property analyst CoreLogic.

CoreLogic’s Home Price Index (HPI) forecasts that home prices will rise a further 0.4% from February to March, while prices are also set to climb 4.7% from February this year to February 2018.

Dr. Frank Nothaft, chief economist at CoreLogic, said that home prices and rents have risen the most in local markets like Seattle, Portland and Denver, where demand is strong and supplies are tight.

“The rise in housing costs has been largest for lower-tier-priced homes. For example, from December to February in Seattle, the CoreLogic Home Price Index rose 12% and our single-family rent index rose 6% for all price tiers compared with the same period a year earlier.

“However, when looking at only lower-cost homes in Seattle, the price increase was 13% and the rent increase was 7%.”

US home prices remain elevated so far this year and are expected to continue posting gains in the near-term as the market is underpinned by high demand, waning supplies and robust employment levels.